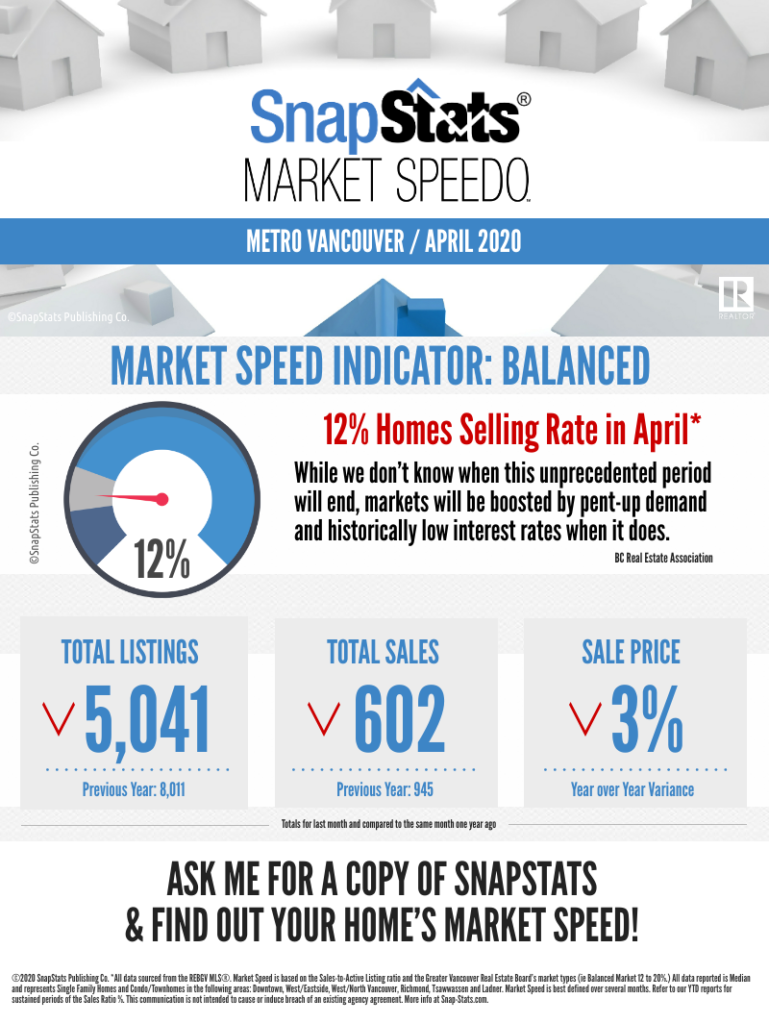

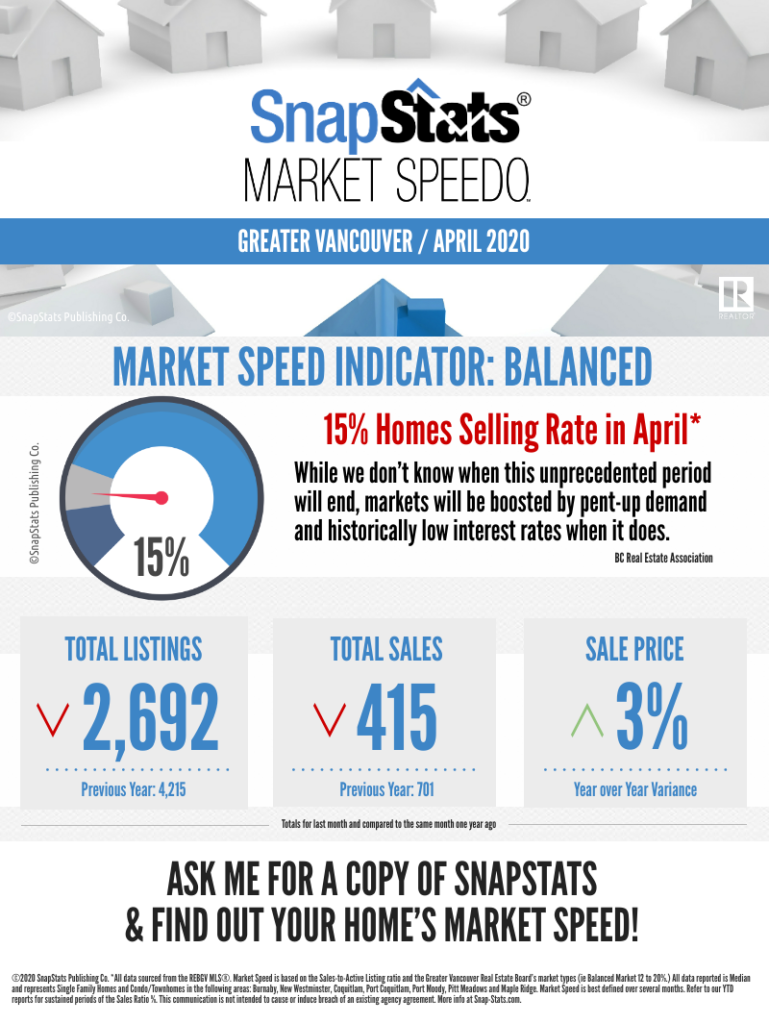

The past year has been very challenging for many Canadians because of the COVID-19 pandemic, which caused a lot of uncertainty and panic. A lot of people lost their jobs and are still unsure of the future, and the experience has been very stressful and overwhelming.

To help alleviate some of the stress, the government released a mortgage deferral program, which allowed Canadians to defer their mortgage payments for six months. This helped people get through financial uncertainty during an unpreceded pandemic but this program has now ended, and homeowners will be expected to start making mortgage payments again.

Many Canadians are still facing uncertainty, so if you do not feel as though you are in a position to start making your mortgage payments again, it is best to reach out to your lender to see if there are other solutions or options they can offer. They may not be able to offer you an extension but they will work with you to offer you some flexibility until this pandemic is contained. Reach out to your branch directly because even if they cannot offer you a full deferral, they may be able to offer you lower monthly payments, so it is definitely worth asking.

Seek Additional Financing

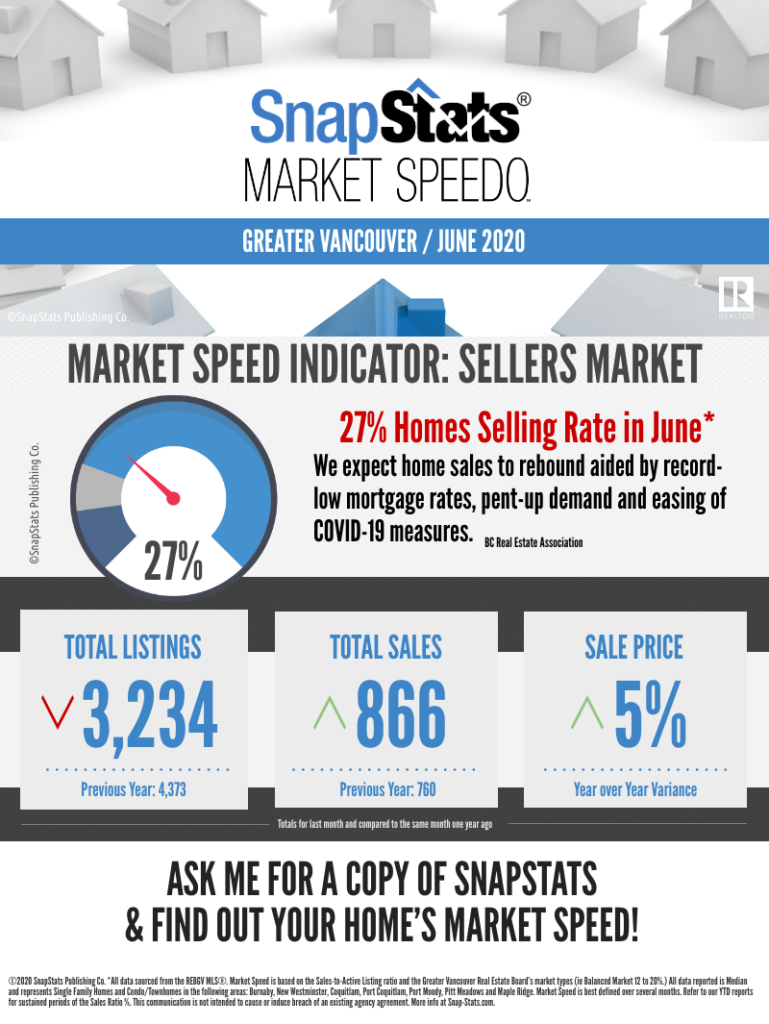

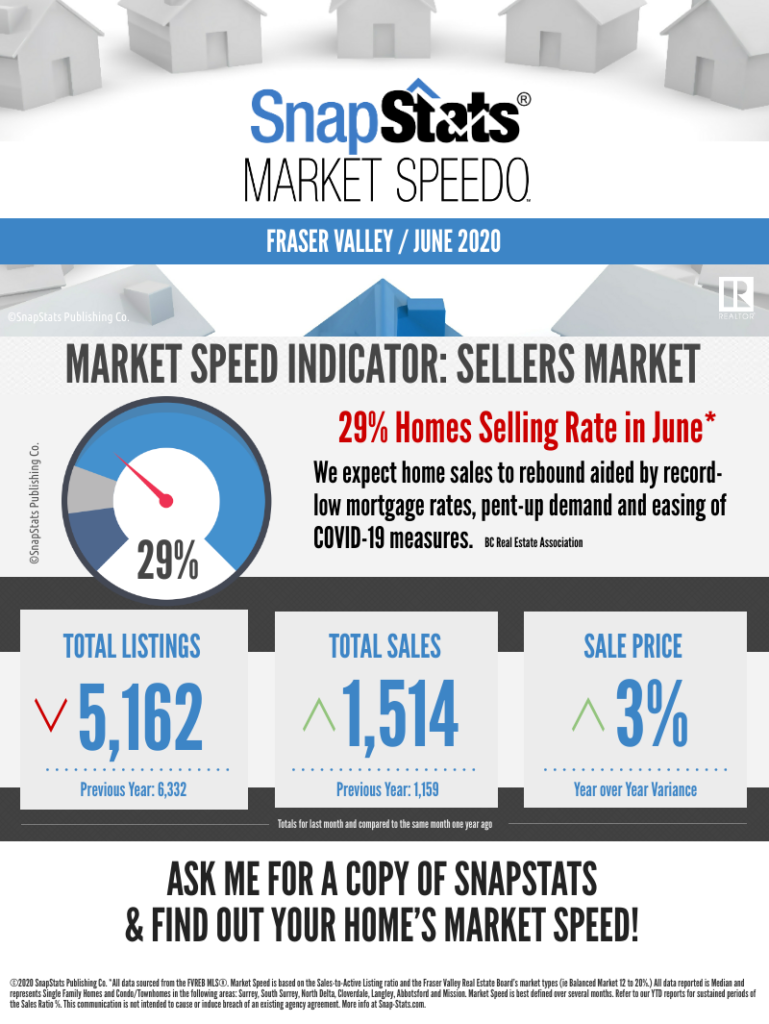

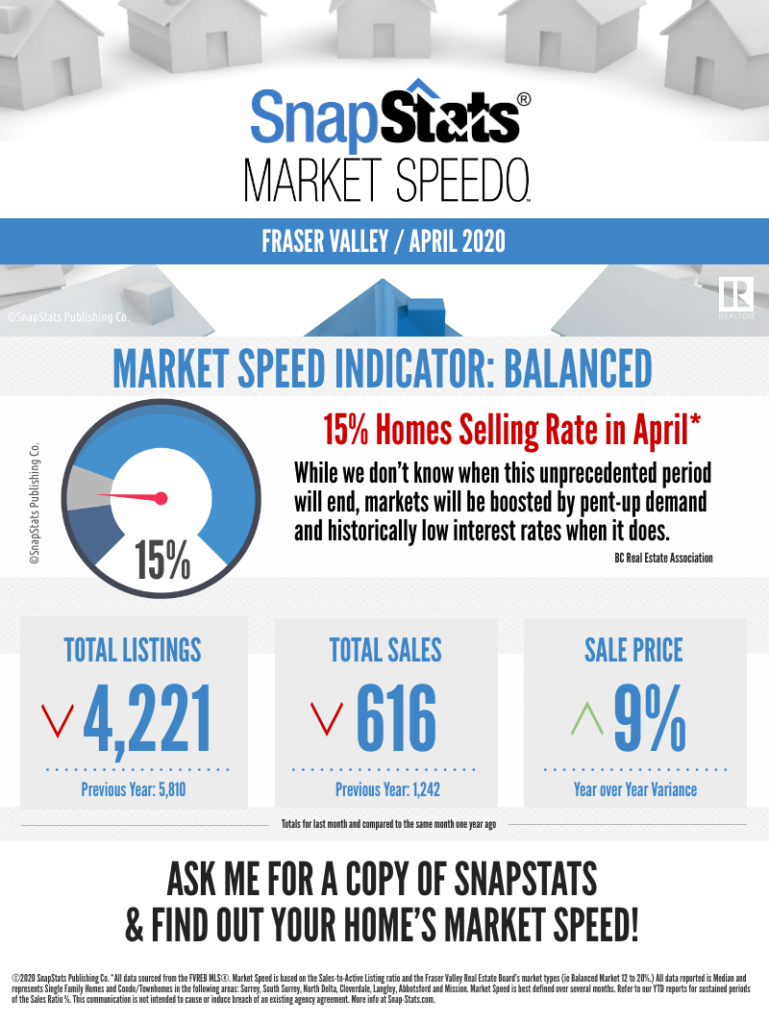

One option you can discuss is refinancing your mortgage because interest rates are very low at the moment. This would make a very big difference, especially if you are currently locked into a fixed mortgage at a higher rate, so ask about this option because it may allow you to significantly lower your rates. Make sure you understand all the details surrounding this option because in some cases, penalties may exist, so you may have to pay a fee if you decide to break a fixed-rate mortgage. Even with these penalties, you may still end up saving a big portion, so it may be worth it, and this is why you need to look at all the details to make an informed decision.

Ask For An Extension

Additionally, you can also ask your lender about the possibility of extending your amortization period, which would add to the number of years you have to pay off your mortgage. You may end up paying more in the long run, but it will make your individual payments easier to manage, so this, too, is an option you can look into.

You can also consider selling your home and moving into a less expensive property, which would help lower your monthly costs while still allowing you to build equity. You can buy a smaller property in the city or move further out, where you may be able to get a bigger property for less. If this is something you are interested in doing, Cherry Yeung Real Estate can help. Our realtors can help you buy a condo or can show you all the houses that are for sale in the Vancouver, Burnaby, and Richmond areas, so if you want to work with a reputable real estate agent, give us a call today!